The recent decision to cut penalty rates in Australia is another step towards widening the gap between rich and poor, writes Ben Debney.

This week’s decision by the Fair Work Commission to cut Sunday penalty rates for retail and hospitality work is rationalised by a supposition that lower wages for working outside of regular hours aids jobs growth — one that has been championed by the Federal Employment Minister, Michaelia Cash, who claims that weekend penalty rates ‘seem to deter weekend work.’

Other defenders have echoed this thinking. “Our retailers have told us quite clearly that they will be employing more people where they are already employing people on a Sunday,” claims Australian Retailers Association spokesman Russell Zimmerman. “Where they have shops closed on a Sunday they will look at reopening the shops on a Sunday to ensure more employment throughout the industry.”

“We certainly believe that, in this day and age, there is no difference to working on a Sunday to working on a Saturday, and therefore we believe Sundays should be paid at the Saturday rate,” said Restaurant and Catering Australia (R&CA) chief executive John Hart. Before and after hours, he said, was “when most of our people work and certainly in the morning, at 6:00am when a lot of cafés are open, that is not a penalty time. It should be just ordinary hours.”

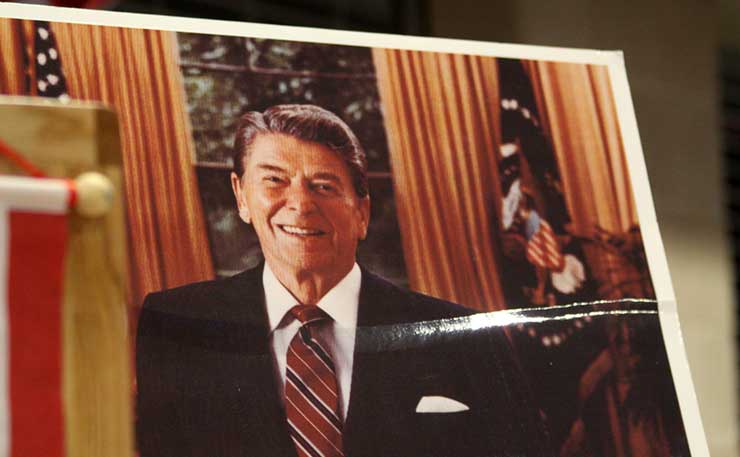

Problematically however, claims such as these, which in connecting penalty rates and the stifling of economic life invoke supply-side, ‘trickle down’ theories historically associated with Reaganomics and more recently with neoliberalism, are based in the first place on the assumption that beliefs and facts are of equal merit, and in the second, on precious little evidence.

The evidence in fact points in the opposite direction, raising questions as to why it does not factor into political and legal decision-making, government or economic policy or ideology.

Furthermore, the active avoidance of evidence to the contrary by those who continue to make claims based on disproven theories and belief systems raises further questions as to the function played by the assumptions, policies and legalisms substituted for the facts to which the evidence points.

In the official report available from the FWC website, the Fair Work Commission decision reflects the basic precepts of supply-side economics while neglecting evidence to the contrary in noting that, “the Full Bench decided that the existing Sunday penalty rates in the Hospitality, Fast Food, Retail and Pharmacy Awards do not achieve the modern awards objective, as they do not provide a fair and relevant minimum safety net.” We must do some work to decipher what this actually means.

The idea of having a Penalty Rate is that employers are penalised for hiring workers outside of regular business hours — an additional payment that compensates those obliged to work irregular hours for the hours not spent with their family, or for the additional stress resulting from unusual volumes of customers and the fact that people who usually work during the week are out and around spending money instead.

Penalty rates are supposed to be a penalty, in other words, precisely because the economy isn’t supposed to be the be all and end all of human existence. Employers are not supposed to like them, otherwise they would cease to be a penalty and just become a regular wage.

Nevertheless, the Fair Work Commission concludes that, “having regard to more recent authority, the terms of the modern awards objective, and the scheme of the FW Act, the Full Bench concluded that deterrence is no longer a relevant consideration in the setting of weekend and public holiday penalty rates.”

The Full Bench accepted that the imposition of a penalty rate may have the effect of deterring employers from scheduling work at specified times or on certain days, but that is a consequence of the imposition of an additional payment for working at such times or on such days, it is not the objective of those additional payments. Compensating employees for the disutility associated with working on weekends and public holidays is a primary consideration in the setting of weekend and public holiday penalty rates.

In arguing that the Sunday penalties “do not achieve the modern awards objective, as they do not provide a fair and relevant minimum safety net” the FWC is in effect making three arguments:

- Penalty rates are deterring employers from hiring staff outside of regular working hours, but should not as this is outside of their penalising function.

- Penalty rates are compensating employees for the disutility of working Sundays, though the ‘material change in circumstances’ tests suggests that no one takes the idea of Sundays as a day of rest as seriously as they used to. Therefore, the disadvantage is not so great. ‘Generally speaking, for many workers Sunday work has a higher level of disutility than Saturday work,’ the report declares, ‘though the extent of the disutility is much less than in times past.

- Penalty rates are doing an injustice to employers, who are doubly penalised though high labour costs and the unjust deterrence function of penalty rates, which should not exist. The FWC report anticipates that “there are likely to be some positive employment effects from a reduction in penalty rates, though it is difficult to quantify the precise effect.”

Ironically enough, the FWC points out in contradiction to its own claim, that “Any potential positive employment effects from a reduction in penalty rates are likely to be reduced due to substitution and other effects”. Cutting penalty rates might create jobs, except when it might not.

This kind of logic is not terribly convincing. In fact, it is not at all convincing.

In the first place, it provides no reason for not interpreting penalty rates as having a penalising function; the FWC claim that penalty is a consequence of a higher rate of pay rather than an objective is flatly false, and patently so. The fact that this flatly false statement is presented as fact, as if beliefs and facts are of equal weight, further belies its pretence to validity, relying on the will not to contradict authority to pass muster.

In the second, the supporting evidence for the claim that “the extent of the disutility is much less than in times past” is incredibly weak, and in fact quite strongly contradicted by the many angry and upset workers affected by the decision who ardently testify to the opposite while protesting outside the Commission.

In the third, even the FWC itself admits that the tangible economic benefits of a reduction in penalty rates are difficult to quantify. If the benefits of something for stated reasons are difficult to quantify, and they cause so many people to be beleaguered and upset, why do them?

The answer appears to lie in the fact that the true benefits go unstated. If what we are dealing with essentially is Reaganomics, or neoliberalism, we have to dabble in history. David Jacobs argues that Reagan’s attacks on unions, coupled with Clinton’s financial deregulation, precipitated rising income inequality. He found that

Stronger unions decrease the differences in earnings within firms. And before the politically induced steep decline in union strength that began in 1981, unions probably were the most effective pressure group that lobbied for policies helpful to less economically fortunate U.S. citizens.

Income inequality has been rising ever more steeply in Australia for some time now. If this is the intended consequence of supply-side economics, then doing something even though the stated reasons are difficult to quantify becomes a question of qui bono? By way of contrast, the level of interestedness on that count is not difficult to quantify at all.

We can quantify it by the level of income inequality in Australian society, which according to a report released in 2015 by the Australian Council of Social Services (ACOSS) amounts to the fact that the earning power of the richest 20 per cent of Australians is five times as much as the poorest 20 per cent.

As the ACOSS report reveals, this difference also gives rise to the fact that the wealthiest 20 per cent of Australians own 70 times as much as the poorest — an average wealth of $2 million each at the top as against less than $44,250 each at the bottom. It is certainly a feature of the FWC ruling on Sunday penalty rates that they affect that 20 per cent of working poor and benefit the 20 per cent at the top, all the more so when we consider that 80 per cent of workers affected are employed by Coles and Woolworths, many of whom have already had entitlements denied them by recalcitrant employers.

If what ACOSS is reporting is true, then there are 70 times as many good reasons as bad ones from the point of view of advocates of supply side economics to treat beliefs and facts as being of equal merit, and ignore facts where they belie beliefs.

Otherwise, insofar as they reflect an upwards transfer of wealth rather than an expanding pool of wealth which all can share, the facts belie utterly the myth that policies favouring those who are already privileged is a meaningful way of stimulating investment and production.

A report released by the International Monetary Fund in 2015 confirms that this Reaganite approach to economic management, now the basis for neoliberal austerity, was really just a big steaming pile of hokey. This seems a development of some interest considering this same institution has been championing the very same approach for the last quarter century.

The researchers calculated that when the richest 20% of society increase their income by one percentage point, the annual rate of growth shrinks by nearly 0.1% within five years.

In other words, not only do supply side economics not ‘expand the pie’ as it were, the opposite occurs. By the same token,

By contrast, when the lowest 20% of earners see their income grow by one percentage point, the rate of growth increases by nearly 0.4% over the same period.

This would appear to go not a small way towards explaining why, after being embraced by all sides of politics as facilitating a ‘rising tide that lifts all boats’, neoliberal austerity policies enacted alongside colossal corporate welfare in the form of tax breaks for hundreds of large companies has produced ever-expanding wealth inequality in Australia.

Nevertheless, Minister Michaelia Cash, for one, not only continues to perpetrate and defend attacks on workers, but accuses critics of using propaganda driven scare campaigns in attributing to her a desire to remove penalty rates. “Unions have a responsibility to represent their members honestly and not to attempt to scare people through misinformation,” she declares — a curious comment coming from a cabinet member of a government so committed to stopping the boats.

But this hypocrisy should perhaps not be so surprising — much less to say the propensity to willingly conflate being criticised and being attacked, which only recalls Donald Trump’s complaints about being the subject of a witch-hunt over the dossier regarding his Russian activities handed to the FBI by John McCain.

In the December quarter of 2008-9, the Global Financial Crisis wiped $3.4 billion from the Australian stock market. A $10.4 billion stimulus package prepared by the Rudd Government spared Australia from the worst of the GFC; its success is lauded to this day. Supply side economics are necessary for economic growth, but when the political class fears for the system, suddenly pump priming and demand side economics are a viable option… a viable option to the tune of $10.4 billion even.

This does appear a little telling. If the false and hypocritical claims around Sunday penalty rates are merely an ideological ruse and a means of effecting attacks on workers’ entitlements and perpetrating class warfare in the name, paradoxically enough, of fairness.

According to this logic, if you try to defend penalty rates, you have a bad attitude towards job creation and you have an entitlement complex for wanting things you should not have. Therefore the state of the economy is your fault, not of those who set policy and control the levers of power — much less to say those who run businesses at their own risk.

In this sense, the socialisation of risk onto the poorest fifth of the country, to part-time and casualised workers who often constitute the working poor and can least afford even minor wage cuts, begets economics as victim-blaming — a classic mechanism of what social psychologists call moral disengagement, and a central facet of scapegoating.

This perhaps also helps to account for the central pretence of this rehashed ‘trickle-downism’ — namely, that the attacks on Sunday penalty rates are part of a larger concern for jobs, as if the market system is based on the ‘jobs’ motive and the only reason people ever go into business is because they love to create ‘jobs.’ We know why people go into business, and it isn’t because of the ‘jobs’ motive.

Perhaps it is because of the nature of this underlying actual motive and the drives it gives rise to, drives on which the whole system turns, that helps also to account for the willingness to blame someone else for any unintended, unwanted and embarrassing consequences. The willingness to blame someone else for the inability to create jobs at the level of policy certainly appears to explain, for example, the preoccupation of the political class and mainstream media with irregular migration.

Such facts recall commentary from John Kenneth Galbraith to the effect that, “When the modern corporation acquires power over markets, power in the community, power over the state and power over belief, it is a political instrument, different in degree but not in kind from the state itself.”

To hold otherwise — to deny the political character of the modern corporation — is not merely to avoid the reality. It is to disguise the reality. The victims of that disguise are those we instruct in error. The beneficiaries are the institutions whose power we so disguise. Let there be no question: economics, so long as it is thus taught, becomes, however unconsciously, a part of the arrangement by which the citizen or student is kept from seeing how he or she is, or will be, governed.

Maybe this is why the modern conservative, Galbraith added, “is engaged in one of man’s oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness”.

In this brave new neoliberal world, where those who can afford it the least are made subject to quite summary wage cuts while corporations and churches pay no tax and billions are squirreled away in offshore tax havens, the rehashing of Reaganisms – even inferior ones, it seems – will do.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.