With the recovery from the Global Financial Crisis still anaemic, the Coalition must use the budget as a chance to invest, writes Ian McAuley.

Wayne Swan and Chris Bowen must be enjoying a little schadenfreude watching the Government struggle with developing a budget in a difficult economic and political climate.

The Coalition’s spells in office have generally coincided with plentiful economic times – the 23-year post-war boom from 1949 to 1972, and the strong growth period from 1996 to 2007. These runs of good luck have undoubtedly contributed to their misplaced confidence.

Labor, by contrast, has had poorer luck. Whitlam won office in 1972 just as a trifecta of disruption was about to hit the world: the end of the Bretton Woods economic order, the Arab oil embargo, and the sudden fall of government spending as the United States withdrew from Vietnam. Then, in 2007, Labor won office just in time for the global financial crisis.

As with the disruptions in 1972, the GFC was no normal business downturn that could be corrected with a shot of counter-cyclical government spending. The Rudd-Gillard Government tried that – the only responsible response available – and while they staved off a costly recession, neither Australia nor most of the other old “developed” countries have seen growth restored to pre-2008 levels. In office, Labor made promises about the budget coming back to surplus, as did the Coalition, but at the time neither party understood the extent and depth of the structural problems facing the Australian and global economies.

And it is not clear that Treasurer Scott Morrison understands them either.

The Turnbull Government’s message is that Australia is going through the difficulties of the end of the mining boom and the shift in the Chinese economy from heavy commodity-intensive investment to domestic consumption.

That’s all so, and we have dealt with commodity booms and busts before. They’re part of our familiar landscape, and when they occur governments have used textbook mechanisms of counter-cyclical spending.

That textbook mechanism is familiar. To stave off a recession the government uses expansionist monetary and fiscal policies to increase demand. As the economy picks up, business and consumer confidence rise. As employment and wages rise there is higher taxation revenue, and less demand for unemployment benefits. These “automatic stabilisers” as they are known help close the budget deficit. Also, inflation may kick in, writing down the burden of both government and household debt, and possibly pushing people into higher tax brackets, a phenomenon known as “bracket creep”.

This time, however, the problem is much worse than a normal downturn and it’s happening on a global scale. To put it simply, the usual stimulatory measures governments have used to breathe life back into their economies have been unable to deal with deep-seated structural problems in most “developed” countries.

Globally, the recovery from the GFC has been anaemic. There have been problems in specific countries and regions, most notably the lack of a central fiscal authority in European countries with a shared currency, and worsening inequality in the Anglosphere. And the general problem worldwide is that the GFC arose from a dysfunctional financial sector that remains dysfunctional, still failing in its basic role of matching those with money to save with those who need funds for investment.

Because various countries have used expansionist monetary policies, including record low official rates and “quantitative easing” (the 21st century version of printing money), there’s no shortage of money in the world, but much of it is in the wrong hands, and little of it is going into productive investment. As governments push money out, it comes straight back to the safety of government in the form of government bonds, and even negative interest rates in many countries cannot entice financial institutions to seek something more productive than government bonds. We’re witnessing a worldwide “strike of capital”.

In some countries, including Australia, banks have been lending money for investor housing, but they’ve been much tighter in lending for productive investment. Not that firms are brimming with investment proposals. In the company reporting season just passed, Australian publicly-listed companies were paying around 70 per cent of their profits as dividends, such is the lack of business confidence.

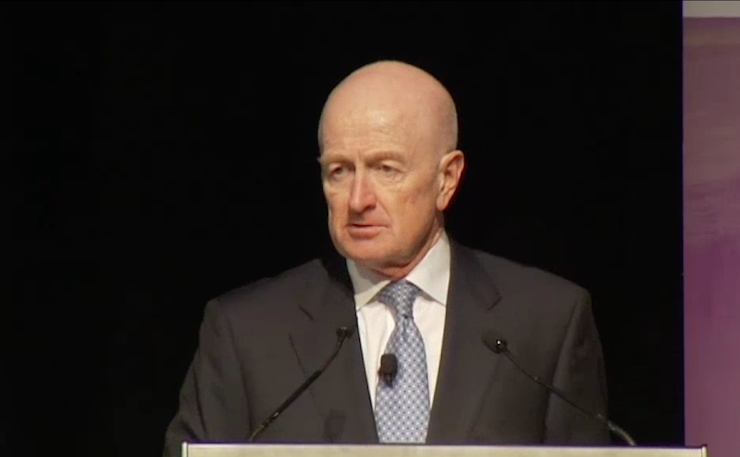

In such a situation there’s not much sense in further monetary easing. Our Reserve Bank Governor, Glenn Stevens, has acknowledged that “monetary policy alone hasn’t been and isn’t able to generate sustained growth to the extent people desire”. That’s an extraordinary statement for a central banker, on a par with a police commissioner admitting that the “war on drugs” has been lost. Stevens has also warned that any cut in Australia’s interest rate is going to make life even tougher for conservative investors.

Nor are the “automatic stabilisers” working. Joe Hockey’s two budgets in 2014 and 2015 carried the expectation that higher wages and bracket creep would deliver revenue to the government, but wages are stagnating, and there isn’t any meaningful inflation, which also means our heavily indebted households cannot expect nominal wage rises to relieve them of the burden of servicing their debt.

In acknowledgement of such problems the OECD is now urging rich countries to contribute a fiscal boost to put some life into the world economy. In its February Global Growth Outlook, OECD Chief Economist, Christine Mann, said: “With governments in many countries currently able to borrow for long periods at very low interest rates, there is room for fiscal expansion to strengthen demand in a manner consistent with fiscal sustainability”, and even the IMF, renowned for its dry economic orthodoxy, is warning countries against austerity.

The implication for Australia is that our budget should be an expansionary one. This is not the time to try to close the budget deficit.

The opportunity lies in public investment: indeed it would be irresponsible if our government didn’t take advantage of low interest rates to invest in neglected infrastructure – urban public transport, interstate roads and railroads, broadband, and infrastructure for renewable energy. If the private sector isn’t going to invest in productive assets then the public sector should fill the gap.

Business lobbies have been urging the government to cut corporate taxes but there’s no point if those cuts are going to be passed through to shareholders (many of whom are foreigners) rather than invested.

Meaningful infrastructure spending (not just the occasional $10 million for a road in a marginal rural electorate) would increase the government’s debt, which stands at a modest 18 per cent of GDP, but provided the infrastructure has positive benefit-cost ratios, our public balance sheet, our net worth, our common-wealth should strengthen. Also, to the extent that well-directed infrastructure improves our economic strength, the ensuing economic growth (or at least the avoidance of stagnation) improves our capacity to repay public debt.

Of course there has to be more to the budget. We need to improve our revenue base to provide necessary public goods, particularly education and health care, and we need to deal with inequality, an affliction on our economy that’s destroying incentives, that’s requiring more and more public spending to be directed to transfer payments, and that’s undermining the public’s belief in the legitimacy of our political and economic arrangements.

There also needs to be fundamental structural reform of the finance sector, both banking and insurance. The Government’s proposals for strengthening ASIC are commendable, but they would do nothing to address systemic problems in the sector. Labor’s proposal for a royal commission would be more useful in exposing structural and cultural problems, but the real challenge is to develop policies that restore banking and insurance to their role as servants of the real economy, rather than casinos where rich gamblers wager the nation’s wealth.

In the early 1970s crisis and in the 2008 GFC, Labor governments were put to the test. This is the first time in many years that a Coalition government has had to face up to a serious global economic crisis.

Will the Coalition be flexible enough to abandon its dogma about the evil of public debt and the worthlessness of government, and bring down the budget we need for our times? Or is that too much to expect – like asking Cory Bernardi to accept the science of climate change.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.