It can be hard to get your head around, but understanding superannuation goes a long way to understanding inequality in modern Australia – and why young voters should throw the Coalition out, explains Ian McAuley.

It’s now almost certain that the government intends to do little, if anything, about the tax rorts related to investment housing.

Similarly, it looks like they will be leaving superannuation arrangements largely in place, even though the tax concessions in superannuation are generating extraordinary inequities – inequities that dwarf those associated with “negative gearing”.

And they’re a huge drain on public revenue – revenue that could be spent on health, education and infrastructure. According to Treasury’s estimates, superannuation tax concessions are costing $33 billion a year in revenue forgone. That’s more than half what the government is spending on the age pension ($61 billion this year).

There are two phases to superannuation, each with generous tax concessions. The accumulation phase is when one’s account is being built up, most notably with the 9.5 per cent compulsory employer contribution. Then there’s the pension phase, post-retirement, when one draws down the earnings. (It’s a little more complex in that there are provisions that overlap these phases but it’s easiest to understand the superannuation policy if they are considered separately.)

Contribution phase concessions: $17 billion a year

The concessions in the accumulation phase apply to taxation of contributions and earnings.

For those with PAYG employment, the 9.5 per cent superannuation guarantee levy (SGL) is paid by the employer. Each month or quarter the employer pays to the employee’s chosen superannuation fund a contribution equal to an additional 9.5 per cent of the employee’s salary. (Some employers pay more.) When the superannuation fund receives it, 15 per cent is paid as a contribution tax to the ATO, and 85 per cent is credited to the individual’s superannuation account. Those contributions are almost unseen by the employee, except as an annual statement from the superannuation fund.

The attraction for most employees is the 15 per cent tax rate.

To illustrate, someone with an income of $100,000 receiving from their employer an extra $9,500 (9.5 per cent of income), would normally pay tax at their 39 per cent marginal tax rate (MTR) on that extra payment, but when it is a superannuation contribution it is taxed at only 15 per cent as it goes into the fund. That’s a 24 per cent tax break. Those on the highest MTR of 49 per cent (incomes over $180,000) get a 34 per cent tax break. The higher one’s income, the better the break.

And there’s more.

People can make additional contributions up to $30,000 a year (more if they’re aged over 49), thereby reducing their taxable incomes, often in the form of a “salary sacrifice” arrangement. As with the compulsory SGL contributions, 15 per cent tax is taken out when these contributions (known as “concessional” contributions) go into the fund.

That $30,000 is the limit of tax-deductible contributions, but people can pay up to another $180,000 a year into superannuation, and such contributions (known as “non-concessional” contributions) are not subject to any tax when they go into the fund. The reason no tax is charged is an assumption that somewhere along the line tax has already been paid in earning that money. Because of that provision, superannuation is a handy place to park an inheritance or other windfall.

Once one’s contributions are in a superannuation fund, the fund’s earnings are taxed at 15 per cent. If similar earnings came from personal investments, such as a personal share portfolio, they would be taxed at the taxpayer’s MTR.

The obvious inequity in these arrangements is that they mean far more to people with high marginal tax rates – namely those with high incomes. Those with incomes under $18,200 (the tax-free threshold) pay no tax on normal earnings, but their employers’ contributions are still subject to the 15 per cent tax on superannuation contributions, and those with incomes between $18,200 and $37,000 whose MTR is 21 per cent, get only a 6 per cent incentive.

To overcome this inequity at the lower end of the income scale, the Gillard Government introduced a compensatory payment up to $500 a year (roughly 15 per cent of $37,000), known as the “low income superannuation contribution” (LISC).

Yet even though Abbott had made a pre-election pledge not to make any changes to superannuation, he legislated to abolish the LISC. In a deal with the Senate it is continuing for a short period, but unless the Turnbull Government extends it, it will disappear in 2017-18.

Another measure introduced by the Gillard Government, which has so far survived the change in government, is the “high-income superannuation charge”. Taxpayers with incomes above $300,000 pay a 30 per cent tax on contributions, rather than 15 per cent. Last year, in the post-budget period, Labor announced that it would reduce this threshold to $250,000 – a change that may be a minor inconvenience to a few surgeons and corporate executives.

Altogether the tax breaks in the contribution phase cost $17 million a year.

Most independent commentators acknowledge the inequities in the contribution tax breaks. (The 15 per cent tax on earnings is less controversial.) One suggestion, with fairly wide support, is that contributions within the tax-deductible limits be taxed at the taxpayer’s MTR less 15 per cent, but no political party has proposed such a measure (although the Greens have a proposal with some of the same design principles). Others suggest lowering the $30,000 tax-deductible contribution allowance.

Pension phase concessions: $16 billion a year and growing fast

The concessions in the pension phase are simpler but even harder to justify.

Once a superannuation account is in the pension phase, all earnings (and drawings) are tax free. The other significant provision is a requirement for beneficiaries to draw down a minimum proportion of the fund’s value each year – five per cent for people aged 65 to 74, with higher requirements for older people.

That means someone with a pension account balance of $1 million earning $50,000 (assuming a five per cent yield) pays no tax, whereas a PAYG taxpayer with a $50,000 salary would pay $8,500 tax, based on present tax scales. Similarly, someone with a superannuation balance of $2 million, earning $100,000, would still pay no tax, whereas a PAYG taxpayer with a $100,000 income would pay $26,900 tax.

Those superannuation earnings are separate from other income streams people may be enjoying – dividends from shares or a defined benefit pension relating to periods of employment in firms or government agencies with such schemes. Someone with a superannuation fund earning $100,000 and who has $18,200 income from other sources would still be paying no tax, whereas the PAYG taxpayer with a $118,200 income would be paying $34,000 in tax.

And that’s before we get on to the possibilities of splitting superannuation earnings between spouses.

The Gillard Government announced that it would tax superannuation earnings above $100,000 a year at 15 per cent. But the Abbott Government made sure that this modest proposal was never legislated. In the post-budget period last year Labor announced it would go for an earnings tax once again, above a $75,000 threshold.

These tax concessions in the pension phase cost public revenue $16 billion this year. What should be of particular concern to policymakers is that they are projected to cost $20 billion by 2018-19. That rapid growth is because the number of retirees is growing, because the effects of 30 years of compulsory superannuation are accumulating, and because over that 30 years income disparities have widened tremendously, which means the very well-off have enjoyed a windfall.

The Superannuation Guarantee Levy: held down for now

The Gillard Government had planned to increase the SGL progressively up to 12 per cent by 2020, and on that timetable it would have been 10 per cent this year. The Coalition has frozen its rate at 9.5 per cent until 2020, before it starts to rise to 12 per cent in 2025. For a long time Paul Keating has supported an SGL rate of 15 per cent.

An SGL of 9.5 per cent is not necessarily inadequate, however. A worker with an income of $81,000 (the present average adult full-time annual earning), with 45 years of unbroken employment, would retire with a tax-free pension income of $54,000, which is 66 per cent of his (unlikely to be her) after-tax income during his working life (assuming he has chosen a reasonably well-performing fund).

The trouble is that such a creature is rare, and is becoming rarer. Unbroken full-time employment is far less assured than it was in the past. If she (or possibly he) takes a five year break from work early on (e.g. for child minding), her income in retirement income is drastically reduced – to $44,000. Similarly, if he or she is in an occupation where one starts with a low salary and moves up through the ranks – a lawyer, a public servant – the benefits of early contributions are lost, and he or she will have a severe fall in income at retirement.

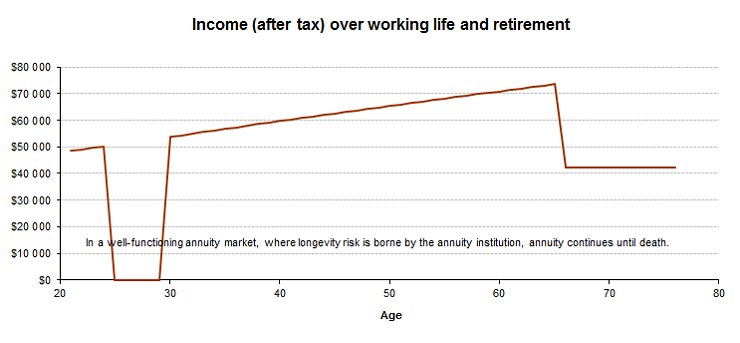

Readers can verify these scenarios or develop their own using my “supermodel” spreadsheet simulation (All figures in “supermodel” are in real terms, unaffected by inflation.) The figure below, for example, derived from “supermodel”, shows the income profile of someone whose average income is $81,000 but who starts on $61,000 and finishes on $101,000, and has a five year break early on.

The sum total: young people should be furious

With people’s workforce experience becoming more varied, it’s difficult to devise a “one size fits all” SGL rate. A rate of 15 per cent (and perhaps even 12 per cent) would have the perverse result for many people of enjoying a higher income in retirement than in their working life – even if they made no extra contributions. (These scenarios can be tested on “supermodel”.) It may be a sound policy to allow or even encourage people to opt-out of SGL contributions once a certain accumulation is reached.

It’s quite reasonable that people should be helped by the tax system to smooth out their income over their lifetime. It’s only an arbitrary convention that we pay income tax annually, and mechanisms that allow some spreading, so that we come closer to being taxed on our average lifetime income make some sense.

But in no way does that justify our paying no tax in our later years when we may be enjoying a quite high income, our houses are paid off, and our children are financially independent. In some situations, particularly when there are early contributions to superannuation, people’s income can rise strongly when they enter the pension phase. Even if the SGL is held at 9.5 per cent, a contribution of $100,000 – an inheritance perhaps – at age 30 can result in such an outcome.

The avowed purpose of superannuation is to provide an income in retirement. It isn’t to provide the well-off with the means to accumulate a fortune in their old age. Even Treasurer Scott Morrison says superannuation is not a “tax-free inheritance pool”.

But that’s what it has become for many.

Some level of government support can be justified on the basis that in time superannuation helps reduce demand for the age pension. For example, when the Gillard Government introduced the LISC, it estimated by 2037 that measure alone would halve the number of people receiving a full age pension – a credible estimate in view of the fact that it applies to people earning less than $37,000.

But that was scrapped by the Coalition Government.

A possible explanation behind the Coalition’s move is that those on low incomes tend to contribute to industry superannuation funds (governed cooperatively by industry trade unions and industry associations), rather than to the retail funds operated by for-profit financial institutions, mainly the big four banks. The Coalition’s cosy relationship with the finance sector, and its pathological hatred of unions may provide some explanation for its policies.

In spite of the superior performance and low fee structure of the industry funds compared with the retail funds, the Abbott Government tried to legislate to change the governance of industry funds so as to weaken the power of the unions, but this proposal was defeated in the Senate.

Another possible explanation for the Coalition’s attitude to superannuation is that it is beholden to older, wealthier voters. Opinion polling consistently confirms that older Australians strongly support the Coalition.

The Coalition’s rationalisation for its permissive approach to high-wealth retirees is to claim they should be free to enjoy the fortunes they have accumulated through their hard work and thrift – a superficially appealing explanation until one considers the tax subsidies and often inheritances that have helped them along the way.

Australians who grew up in the postwar years – the “baby boomers” – have been extraordinarily privileged. They have drawn heavily on the services funded by taxes paid by their parents’ generation but are selfishly not reciprocating to pay for their own children’s generation. Besides these superannuation injustices, younger Australians are bludgeoned into paying private health insurance to support the old, are made to pay high university fees and to repay student debt (to support those who in their day enjoyed free tertiary education), and are locked out of the housing market by wealthy older people enjoying tax rorts.

At the last election 400,000 young people failed to enrol to vote, and an unknown additional number would have enrolled but not voted. It’s understandable that young people are disgusted by the corruption, hypocrisy and lying they observe in so many politicians.

But nothing will change unless young people mobilise and throw this mob out.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.