No seriously, why are we still working? Mike Dowson explains in simple terms the great con that keeps you chained to the wheel.

This may be an opportune moment to consider the question. Especially if you’re not actually working.

You may have retired. Perhaps you’ve just left university, considering your options. Perhaps you’re taking a welcome break.

Maybe you have no choice but to take a break. Did you retire early because your job was axed? Has the casual work you depend on dried up? Have you been unable to find a job, despite your qualifications?

Perhaps, as you read this, you’re at work, filling in time, forgoing a holiday. Or at the beach, while the kids play in the surf, watching for emails on your phone.

Of course, it’s obvious why we work. Money. You don’t get something for nothing. And everything is so expensive these days.

If anything, most of us need to work more. Both spouses, extra hours, second jobs. Would anyone, except an idiot, seriously suggest we should all be working less?

Well, actually, yes.

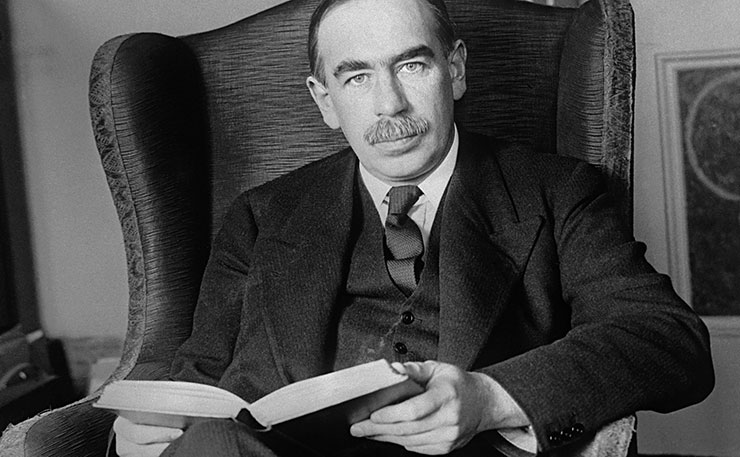

As long ago as 1930, the economist John Maynard Keynes predicted that, by now, people in technologically advanced societies wouldn’t need to work much at all. When Keynes said this, advances in technology were yielding extraordinary increases in productivity. The implications seemed obvious. If it took less time to produce what we needed, surely we’d work less.

It turns out that for much of the 20th Century average working hours in developed countries steadily fell. Then, around the 1970s, the trend plateaued. In some countries, it reversed and working hours began to climb again. This occurred at the same time women were entering the workforce in great numbers so total workforce participation also increased.

In Australia, by the new millennium, many full time employees were working more than their grandparents had.

What happened? Did technology fail to deliver the gains Keynes expected?

On the contrary. Technological advancement outstripped even the giddy imaginations of futurists from a century ago. We can grow food, dig up minerals, make fridges and bridges, move things and ourselves around the planet and share knowledge and information much faster with a fraction of the workforce it once took.

But if staggering productivity gains haven’t manifested as lower working hours, where did they go?

Some prominent economists, including some Nobel laureates, have grappled with this question.

Gary Becker observed that our appetite for material goods has expanded along with our ability to produce them. Instead of working less hours, we opted for bigger houses with more gadgets, which we replace more often.

This process has been fuelled by a deluge of marketing, which persuades us to consume things we previously didn’t recognise a need for.

Does that explain it? Anthropologist David Graeber doesn’t think so. If it continually takes fewer human hours to produce these things, shouldn’t we be able to afford them without working more? What are all these working hours producing?

Graeber argues that, although productive jobs have, in fact, been steadily automated away just as predicted, we have also seen a vast proliferation of new jobs that only seem to exist to keep people working.

Consider this. Productivity growth has stalled in Australia. How can this be? Technology hasn’t stopped advancing. The time we should be winning back through productivity gains must be getting reabsorbed.

Productivity returns are highest in capital-intensive industries like mining and manufacturing. As those jobs disappear, either replaced by technology, or lost altogether, the workforce moves into labour-intensive industries like hospitality and professional services. This dilutes the gains in the other industries.

At the same time, unemployment has been trending up since 2008. Young people especially, are out of work. The number of underemployed people, who would work more if they could, is also high. More jobs are casual.

There’s a downward trend in job prospects for new graduates. Some of them settle for part-time work or a free internship. Many find work which is unrelated to primary qualification. That’s now more likely to be in a job without benefits, or multiple such jobs.

There’s another factor. Our lives are now longer relative to our working lives. We tend to start full-time work later, after years of study, and more of life is spent in retirement. Many jobless older people are struggling with the cost of living. Many would work more if they could.

Instead of everyone working less, what seems to be happening is that experienced workers, in professions which are still in demand, are working more, while the young, the old, and those with skills which no longer attract investment have difficulty finding work.

MIT academics Andrew McAfee and Erik Brynjolfsson refer to this as the great decoupling. For many years, real GDP per capita and median income rose in tandem. Since the 1970s, wages as a percentage of GDP have fallen dramatically, while corporate profits as a percentage of GDP are now at their highest level, despite recurring economic shocks.

To put it simply, labour isn’t as important to growth as it used to be.

There is nothing in the economic outlook or current government policy settings which suggests this trend is going to change.

Automation, artificial intelligence and robotics are encroaching on more human occupations. The Committee for Economic Development of Australia (CEDA) has estimated that as many as 40 per cent of the jobs that are left are vulnerable to replacement by technology over the next decade.

No matter how many politicians chant the jobs mantra for the media, more productive jobs are going to disappear.

The terrible irony in this situation is that there is so much that needs to be done.

Among the underemployed graduates I personally know of, there is a psychologist, a soil chemist and a biodiversity specialist. Have we run out of things to do in the areas of mental health, agriculture and the environment?

Mental illness is widespread. Our food bowl is under threat from climate change. We have a mass extinction on our hands.

What we don’t have, apparently, is sufficient money to invest in making full use of the talent that is available to face these challenges.

Why? What failure of collective enterprise could result in this absurd incongruity?

Capital, like technology, is largely blind to human need. Capital goes where the profit is. If there was profit in healing minds and saving species, some of it would go there. While there is more profit in alcohol, gambling and deforestation, more of it will go there.

People don’t register their desire for a healthy society by shopping for it. Capital doesn’t get that signal through the market. The argument that consumers somehow direct the course of civilisation by choosing dolphin-friendly tuna and “eco” cleaning products is stupid and facile. The factors that most affect our destiny are not options in the supermarket.

If a healthy society is something we want, we have to act collectively. Since few people are active major shareholders, for the time being that task tends to fall to governments.

Whether enacted via direct spending, or by creating incentives for private investment, government initiatives are funded from collective surplus – in other words, tax revenue or borrowing against future earnings increases. Despite political spin to the contrary, our tax is low compared to the OECD as a proportion of GDP.

The great decoupling has coincided with rising inequality. Those with money to invest get rich. Those with only labour to sell miss out. Capital doesn’t like to pay for labour, and it doesn’t like to pay tax either.

But why, if our labour isn’t needed for profit, are we still working?

Faced with a looming crisis in social services, but committed ideologically to low taxation, successive Australian governments used tax concessions to turn superannuation and real estate – where most Australians keep their wealth – into a mini-capitalist alternative to social security.

Of course, this only works while people have jobs that provide super and sufficient income to buy housing. And it doesn’t help the real economy, the place where we apply technological innovation to produce things of real value, especially things we can export.

Nevertheless, one group of people enriched themselves through property investment, pushing up the value of real estate around the country in the process. Another group of people became affluent with nothing more than a job that paid super and a home in a good location.

With commodity revenue pouring in from overseas, it was easy to believe we had discovered some kind of magic prosperity formula. But the surplus generated from commodities mostly wasn’t invested back into productive activity. Instead it was turned into tax cuts and other benefits. These had broad electoral appeal but favoured the wealthy, and encouraged further speculation.

The real estate boom didn’t make the country richer. Nor did it make housing more accessible. It simply transferred wealth from one group of people to another. In the process, it put a basic need out of reach of many, including young people, and diverted investment from the productive economy. It also lured a huge number of Australians into precarious debt.

Contrary to popular opinion, encouraged by unscrupulous politics, we have relatively low government debt, but we now have the largest per capita private debt in the world.

So why are we still working? Because we’re in debt.

Middle-aged people are the ones working long hours. They’re also the ones buying houses. And they’re the ones with the most credit card debt as well.

The generation before them had affordable housing, job security and a real social safety net. They’re not so fortunate, but for the ones after them, a steady job with enough for a deposit has become a kind of Holy Grail, and social security is survival at best.

The current trend points to a time when a young graduate might start adult life with a HECS debt, go into credit card debt on a part-time job and a free internship, and eventually get into massive debt to own a flat her grandparents could have bought with ease.

She might even find a job in financial services, if they haven’t all been automated. It’s the sector that helps wealthy people turn their money into more money. It’s also where ordinary people go to borrow money for a house.

Debt is profitable. Even during the great decoupling, as productive jobs disappear, and real wages fall, it’s proven possible to harness the aspirations of ordinary people for profit, without any of the effort or intelligence required for developing new productive capacity, by simply enticing a greater proportion of personal income into servicing debt.

The mining boom is over. Not that it was ever as important as the miners like to claim. Manufacturing continues its long decline. The banks have been warned they are overexposed.

Whatever combination of policy levers is applied, we need to create the conditions that direct investment into producing things that we and the world need, while caring for our environment and our population. We don’t need to direct it in into unearned private wealth at the expense of our neighbours, our country and future generations.

Our current class of politicians has so far failed to even acknowledge our present circumstances, let alone articulate a credible vision for change. Many of them became rich from property investment. Our Prime Minister is a former banker.

Naturally, the people who’ve done well for themselves are reluctant to sacrifice their advantage. Nevertheless, we have to change the narrative around “wealth creation” from one which is essentially about personal enrichment from gaming the system, to one which is about mutual benefit through innovation and productivity.

Change has come, whether we like it or not. If we respond intelligently, taking advantage of the potential we have developed through our education system, we may very well end up working less, but not in a divided society, with many of us struggling to survive.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.