What’s good for the goose is not always good for the gander. Or Greece, particularly when a mining magnate like Andrew ‘Twiggy’ Forrest is involved. Gilchrist Clendinnen explains.

Last week, with little fanfare or fuss, Fortescue Metals did something that the Greek Government has been trying and failing to do for over seven years.

Purely due to concerns about their ability to repay their massive debt obligations, they were able to get their creditors to write off $122 million dollars in debt. This was done without any special appeals, government intervention or political pressure.

There are more similarities between Fortescue Metals and the Greek Government than you might think. Much like the Greek Government, Fortescue metals could be accused of being a little too free with cash in times of plenty.

From 2009 to 2013, with the mining industry booming, Fortescue Metals increased their debt by an astonishing 280 per cent, piling on $9.93 billion of debt in the process. With Iron ore prices high, finding borrowers was easy and Fortescue’s share price soared accordingly.

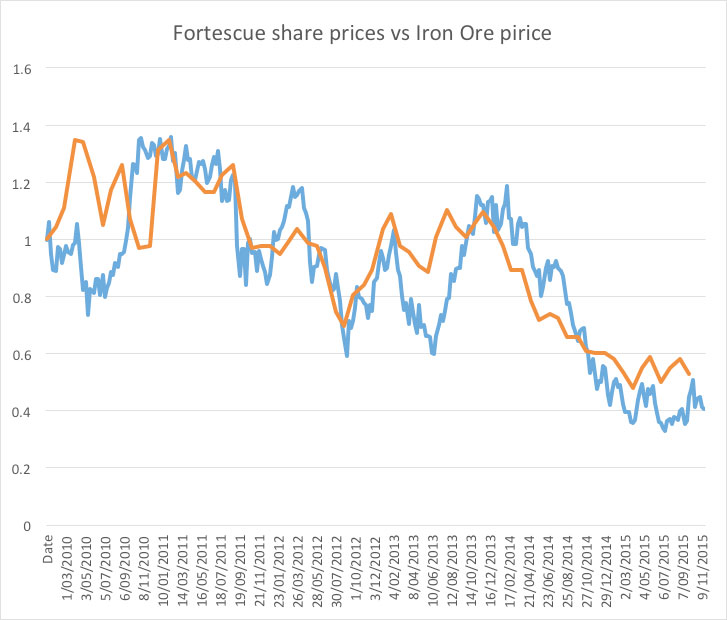

Again, much like the Greek government, the crash came quickly. In late 2013/early 2014 as the Chinese economy slowed, iron ore prices began to drop. As prices fell, so did Fortescue’s share price. The graph below charts the percentage changes in the price of iron ore and Fortescue metals shares over the last five and a half years.

As the situation continued to worsen, attention soon turned to Fortescue’s debt. Analysts realized that Fortescue was going to struggle to break even with Iron ore prices where they were, much less meet the massive debt repayments that they had committed to in the next few years.

As a result of this concern, the corporate bonds that Fortescue had sold in those boom years began to trade at considerable discounts. A bond is basically a promise that a company will pay the owner a set amount of money on a certain date. With Iron ore prices where they were, the concern was that by the time Fortescue’s bonds matured the company would be bankrupt, leaving bond holders with essentially worthless pieces of paper.

Unsurprisingly no-one fancied being left in this situation, and Fortescue bonds started to trade as low as 75 cents in the dollar.

This is where the story gets interesting. On the 11th of November 2015, Fortescue announced that they intended to buy back $750 million worth of their own bonds that were maturing in 2019 and 2022. As these bonds were trading at a significant discount, Fortescue would effectively be cancelling portions of its own debt.

Creditors lined up at this chance to cut their losses. By last Monday the deal was complete. Fortescue has managed to buy $750 million worth of bonds for only $618 million dollars, effectively making a saving of 122 million dollars.

Without any special appeals and minimal fuss, Fortescue had managed to convince their creditors to reduce their debt purely because they were less likely to pay it back.

Needless to say, Fortescue’s creditors did not agree to this deal out of concern for the company. There were no impassioned speeches about the need for debt relief by Fortescue’s CEO or demonstrations by Fortescue shareholders outside major banks.

Instead, this was a cold-blooded commercial decision. Fortescue’s creditors decided that given Fortescues financial position they would rather take $618 million now, rather than the promise of $750 million plus interest in 4 or 6 years’ time.

The contrast with Greece couldn’t be starker. Since the Greek debt crisis broke in 2008, throughout the numerous bailout agreements, Greece has never been able to get a cent taken off its massive debt obligations.

This is despite Greece reaching much more perilous financial positions than Fortescue on numerous occasions. Every new financial bailout has simply included the loaning of more money to Greece, further increasing the amount that the Greeks will one day have to pay back.

Throughout these bailouts, the IMF has given repeated warnings current debt levels are simply unsustainable and that Greece will be unable to repay its debt without some form of reductions.

However, Germany has continued its steadfast refusal to even consider debt reductions even when Greece has been on the brink of bankruptcy, a situation where Germany would have ended up losing nearly all of the money that it was owed.

From a purely financial perspective Germany’s behaviour over the last five years makes little sense. As the Fortescue creditors understood, sometimes it is better to cut your losses than be left with a massive loan to an entity going bankrupt.

The problem is, as numerous commentators have pointed out, Germany is not motivated purely by economic concerns in this situation. The idea of a write down in Greek debt is immensely unpopular in Germany, meaning it would be political suicide for any politician to agree to it.

Furthermore, if Greece manages to get a reduction in its debt, there is the concern that other heavily indebted countries like Spain and Italy would soon be lining up expecting the same thing (funnily enough, no-one worried that GlenCore and Rio Tinto might get the wrong idea when selling Fortescue’s bonds back to them at a discount).

Germany seems prepared to let Greece go bankrupt, at significant financial cost, rather than even consider small reductions in Greece’s debt.

There is a strange idea of morality around inter-country debt which is not raised in the corporate setting. This allows companies to be much more flexible with debt and explore a wider range of options than are available to sovereign countries.

This advantage extends over individuals as well. One can imagine the response that you might get if you tried the Fortescue equivalent with your own personal loan.

Although banks happily sell your debt at cents in the dollar to debt collectors, I sincerely doubt they would ever respond well to a suggestion like this: “Look Mr Bank Manager, I know I still owe $15,000 on this car loan of mine, but since last year I’ve actually lost my job and picked up a drug addiction so to be honest you’ve really got Buckley’s of me ever paying you back. How about I just give you this $10,000 I got from selling the car and we call it even?” You would be laughed out of the building.

The future for both Fortescue metals and Greece remains precarious. For Fortescue, if Iron Ore prices fall further there is still a large chance the company will go bankrupt, while a number of economic commentators much smarter than me remain concerned that Greece will be unable to meet its repayment obligations under the most recent bailout deal.

However, despite a potential Greek default having a much larger negative social effect, it seems clear that Fortescue will continue to enjoy a wider range of options in dealing with its debt than will ever be available to Greece.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.