Can’t afford a home deposit? Want to help drive the already insane price of housing into the stratosphere? Claire Connelly unveils a few simple strategies.

I hate to burst your bubble, but allowing Australians to use their super to buy property is a really bad idea.

When even the banks are calling for a calm on prices, you know there’s a problem.

NAB chief Alan Olster said during the week that housing markets in Sydney and Melbourne continue to ‘defy belief’, with median dwelling prices climbing up to nine times higher than gross household incomes in Sydney and seven times higher in Melbourne, on the back of surging investor demand.

There have been more than a handful of suggestions road-tested in the press about policies to make housing more affordable. Few, if any, will result in anything but higher prices.

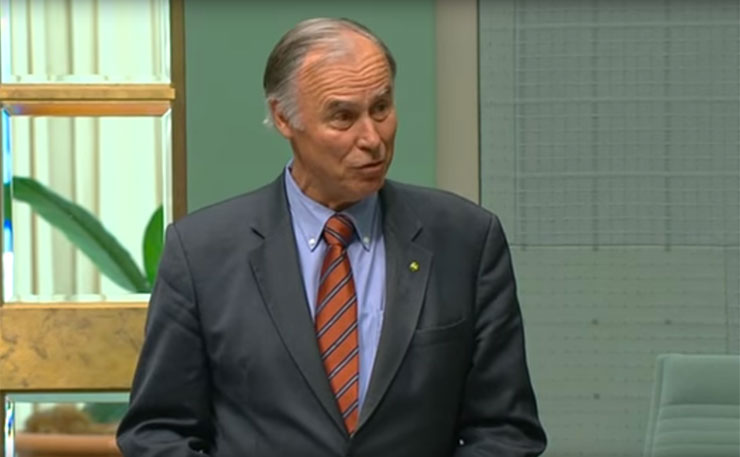

Last week the Federal MP for Bennelong, John Alexander suggested in a piece for The Huffington Post three core proposals to making housing more affordable:

- Empowering APRA to target housing market volatility (even though it already has the power to do this, but generally hasn’t).

- Allowing Australians to access their superannuation fund to pay for a property.

- ‘Open up vast tracts of affordable housing supply by boldly taking action connecting the big cities with their regions via fast rail connectivity’.

Economist Philip Soos described allowing people to access their super to buy a property as a ‘poor policy to further inflate housing prices’.

“The Liberals floated the policy back in 2016 suggesting high speed rail could link the cities to regional areas. It had little to do with transportation policy or housing affordability as opposed to spreading the bubble-inflated housing prices of the capital cities to regional areas instead,” Soos told New Matilda.

Alexander says he rejects the Opposition’s housing policies because it could crash the market, but how could a market crash if there is no bubble?

“He is implicitly admitting to the existence of the bubble despite the fact the party doesn’t want to admit it,” Soos said.

“Allowing first homebuyers to access super will not make property more affordable. If anything, it will drive up demand and hence prices. They will simply draw upon what they have in their accounts to supplement their deposit or take upon a larger loan than they would otherwise have. All it does is increase demand further.”

The policy is a rhetorical oxymoron.

“It’s all about creating more affordable expensive property, that’s what it is,” he says.

Futurist Accountant and Accodex CEO, Chris Hooper told New Matilda that the Australian economy is being propped up by immigration and the “seemingly endless foreign money”.

“I’m not going to trust banks, politicians or boomer economists telling me there’s nothing to worry about, when they all have investment property portfolios,” he said.

Hooper described opening super to pay for property as “ponzi finance which will bankrupt a generation”.

“The music will stop,” he said.

Hooper decided to forgo the deposit he had saved for a house and put it into building a business instead.

“I’m not going to buy a house until I can pay for it in cash,” he said. Having just turned 30, Hooper is one of many in Generation X and Y (we are not millennials, a topic for another conversation) who worry over Australia’s rapidly increasing private debt.

In 1987, the median price of a home in Adelaide was $74,500. In Melbourne it was $89,500, Brisbane $63,500, Perth $61,225, Hobart $63,450, Darwin $81,075, Canberra $90,125, Sydney prices were already high in 1987, around $120,025.

“For my friends in Sydney, the ratio moves from 5.6 times in 1987 to 12.7 times in 2016,” said Hooper. “If property had kept track with inflation, the Australian Bureau of Statistics’ own calculator says that median house price should be $171,225. Sure, our average salary would only be $51,988, but at least those ratios would have stayed in check.”

The average full-time ordinary earnings for the November ‘87 Quarter in South Australia was $435 a week or $22,620 a year, according to the ABS. In NSW the average was $451.40, In Victoria $454.10, in Queensland $432.60, In WA it was $461.10, Tasmania, $438.70, the NT $484.30 and the ACT $509.10.

The average full-time ordinary earnings for the November 2016 Quarter in South Australia put weekly income at $1444.90 per week, according to the ABS or $75,134.8 a year. In New South Wales that figure is $1537.60 a week or $79,955 a year, Queensland $1480.00 a week or $76,960 a year, in WA the weekly earnings averaged $1701.80 a week or $88,493.6 a year, Tasmania $1344.10 weekly or $69,893.2 a year, The Northern Territory $1633.10 a week or $84,921.2 a year, the ACT $1744.00 a week or $90,688 a year, and Victoria, $1494.50 or $77,714 yearly.

Here’s a reality check:

Over the last 12 months, Australia has lost 34,000 full-time jobs (in net terms) and added only 91,500 overall. In fact, Australia just marginally survived a technical recession. In November 2016, there were 725,000 unemployed people in Australia, according to the ABS. Another 1,070,000 were underemployed (that is working part time or casual). There are another million or so people who are not included in these statistics because they either are unable to commence work within the next seven days, or haven’t worked in the last four weeks.

Australia also happens to be second only to South Korea in aged pensioners falling below the poverty line. Household debt to disposable (after tax) income is now over 180%, to GDP it is about 125%. Private debt to GDP is just over 200%.

Do you know what happens when a bunch of people who don’t earn enough money or work enough hours take on a buttload of debt to compensate for the fact that they don’t earn enough – at work – to support even a basic standard of living? Let alone the unemployed, part-time workers, those for whom the cost of childcare or the care of a loved one, outweighs the benefit of a salary, or who cannot work due to illness or injury.

Bad things happen.

Roughly 40% of Australian jobs are predicted to be replaced by automation within the next 15 years. There has been no guarantee from any government that those workers will have news jobs to replace their old ones in different industries. What happens if a business goes under, or decides to outsource its workforce, and all of a sudden Australians who have been leveraged up to their eyeballs in debt can’t make their mortgage payments? A glut of properties will hit the market and POP! The bubble bursts.

America’s housing bubble burst when household debt to GDP ratio peaked at 98% in 2008. Australia’s ratio is at 123% and rising.

Dr Steven Hail, senior economics lecturer at The University of Adelaide told New Matilda the elimination of involuntary unemployment and underemployment would raise GDP by at least $50 billion.

“The long term supply-side benefits and positive social benefits are far greater than $50 billion but would be incalculable without making a heroic set of assumptions,” he said.

Economic insecurity – and instability – has come to such a point that even households many of us would consider to be ‘well off’ are just as – if not more vulnerable – to having the rug pulled out from under them.

This is not a single-generation issue it is one that reaches across all generations, classes, and communities.

The economist says it has been so long since the last property crash in Australia that many people don’t remember what it is like and consequently have taken on so much debt that politicians don’t dare allow house prices to fall.

“Instead, they grasp desperately at any idea that might support prices and hold off a price correction,” said Dr Hail. This is just another in a long series of foolish ideas. Using super to prop up the property market would just add to and prolong the bubble, and make an eventual crash more probable and more severe.”

Wealth inequality may mean that fewer people possess more of the country’s income but it doesn’t mean that the banks aren’t forking out billions of dollars in loans to millions of Australians who have either borrowed too much, or who shouldn’t have been borrowing at all. And I’m not just referring to millennials here. The relative security of what is left of the middle-class and those above the age of 40 will not protect the market from tanking when the bubble bursts, and burst it will.

Economist Philip Soos says with interest rates bottoming out, the government has but two choices left: wage growth or lower prices. Prevention control could address issues of access and affordability. APRA already has this power but the economist says it has “sat on its hands between its inception in 1998 and December 2014”, when it put a 10% annual limit on investor debt growth, while household debt and house-prices increased rapidly over this period.

“APRA has a wet lettuce leaf approach and the banks know it,” he says.

Tax concessions for property investors could also stand to be cut or eliminated entirely. Australia has world’s highest tax concessions relative to GDP, according to the IMF. The concessions are largely dominated by housing and super.

“You’ve got the 50% discount on capital gains tax for investors, including negative gearing,” says Soos. “The capital gains and land tax exemptions for homeowners amounts to tens of billions of dollars annually. We’ve not seen any reform of that. Of course there should be stringent macroprudential controls implemented to stunt household debt growth but that simply has not been done.”

“As Alexander wrote recently, he doesn’t want prices to go down. Having talked to him personally he wants them to level off and go no further. This unfortunately allows existing owner-occupiers and investors to unfairly capture the unearned capital gains made over the last two decades.

“This policy sets one party against another. You can’t have existing owner occupiers and investors wanting higher prices while at the same time wanting to create more affordable prices for aspiring first time owners. There is a clear contradiction.”

The last thing we should be doing is letting first-home buyers give away their nest-eggs to finance a property. When that bubble bursts, people will lose their homes. There will be nothing left but a bunch of fire-sale priced homes that still no one can afford to buy and debt no one can afford to pay.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.