Trump’s election saw a bounce in America’s stock markets, but this is purely about financial speculation because his economic policies, to the extent that they have any coherence, will only exacerbate America’s economic problems, writes Ian McAuley.

By most measures America’s economy is in poor shape.

It has taken seven years for unemployment to return to where it was before the 2008 financial crisis, over which period annual economic growth has been a sluggish two per cent. While the well-off have enjoyed huge rises in incomes and wealth, average wages, in real terms, have stagnated – in fact they are now a little lower than they were in 1970.

While the west coast and northeast states prosper, most states in the south, the rustbelt states along the Great Lakes, and most farming regions, languish. The nation’s transport infrastructure, once the envy of the world, is crumbling. Its health care costs, at 18 percent of GDP (the highest in the developed world) are a drain on other sectors – while delivering poor health outcomes. And while American firms have made many technological breakthroughs in renewable energy, the country is one of the world’s worst emitters of greenhouse gases (Australia and the US compete for first and second place as the highest emitters per head among “developed” countries).

This economic malaise goes some way to explaining Trump’s victory. Let’s not forget, however, the Russians, the Florida Elections Commission, and the organized political power of the “white born-again/evangelical Christian” churches in contributing to this outcome.

But will his policies, to the extent that we can make sense of them, address the country’s deep-seated structural problems?

What we can gather from his statements and his early moves is that he seeks to cut taxes, increase infrastructure spending, increase defence spending, abolish the Affordable Health Care Act (“Obamacare”), deregulate business, withdraw from any action to address climate change, and bring back American jobs through tariff protection.

Tax cuts and spending proposals

Let’s consider the first group of these measures – his tax cuts and spending proposals. These include his proposals to replace Obamacare – which required health insurers to cross-subsidise people with chronic and pre-existing conditions – with a budgetary payment to subsidise insurers to cover these same people.

The trouble with this suite of tax cuts and spending proposals is that the US is already running a significant fiscal deficit – 2.6 per cent of GDP, and its accumulated government debt is 105 per cent of GDP (almost three times our level, over which our treasurer makes so much fuss). It would be OK if this debt had funded investments in infrastructure, environmental repair and education, but as Wolfgang Streeck points out, it has accumulated as a result of a failure to tax the rich.

He proposes cutting taxes in a country whose tax revenue, at 26 per cent of GDP, is way below the average of other prosperous “developed” countries (37 per cent of GDP), out of which it is funding an already large defence budget. No wonder the US has such miserable social security support and such impoverished government services.

Assuming Congress passes some of his proposals (they are more likely to pass his tax cuts and defence spending rather than his health insurance and infrastructure spending), the almost guaranteed response from the monetary authorities – “the Fed” – will be to raise interest rates. If they do not, there is a high probability of an inflationary surge.

Either way, through higher interest payments or higher prices, highly indebted households and businesses will suffer, and some financiers are already warning that interest rate rises resulting from his fiscal profligacy could tip America into recession next year.

Donald’s Deregulation

Then there is his “deregulation” push, where his first move has been to propose watering-down or repealing the Dodd-Frank Act – Obama’s attempt to regulate the financial sector to prevent another 2008-type crisis.

This is foolhardy. Governments world-wide spent all their fiscal and monetary ammunition to deal with the 2008 crisis, and have no capacity to deal with another. The result of another 2008-type asset bust would be along the scale of the 1930s Depression.

Perhaps looser standards on banks would see some boost in business investment, but any project unable to get up in today’s low interest-rate environment (but which would get up with looser financial regulation) must be pretty shaky.

It’s a fair guess that the only beneficiaries in the short-term would be banking executives who could boost their firms’ balance sheets with heaps of junk loans, and get out with their bonuses before it all comes tumbling down. And if international financiers believe American bankers are lowering their already slack standards, the result will be a higher risk premium, translating into higher interest rates for households and businesses.

Trump protectionism

Then there are his tariff proposals. Trump may have had luck in real estate and hotels, but he doesn’t understand real businesses and he doesn’t understand economics. He sees trade in combative terms, not realising that the benefits of freer trade are only partly in terms of American access to foreign markets. Rather they are mainly in terms of lower-cost consumer goods and industrial inputs in the US.

Nor does he understand that it’s been technology, not lower protection, that’s wiped out most manufacturing jobs. Perhaps he might get a couple of car plants to shift back across the border to the USA, but they won’t bring many jobs with them.

If Trump manages to trigger a global trade war there will be losers all around, including the USA. There are plenty of suppliers of aircraft, earthmoving equipment, computing equipment and industrial machinery other than the USA.

Similarly, if Trump manages to withdraw the US from the Paris climate deal he may slow down the demise of America’s coal industry, but a likely consequence is the shift of the whole alternative energy industry – one of the world’s few assured growth industries – to Germany, Korea, Canada or China (would the Turnbull Government have the wits to take advantage of this opportunity?) And it would be within the rules of the World Trade Organization if, in response to America’s recalcitrance on climate change, other countries were to impose trade sanctions against it.

Immigration policies

Finally there are his immigration policies, which have evoked a negative response from many businesses, including a group of almost 96 big companies that have filed a lawsuit against his immigration bans.

Google has announced that it will make a multi-million dollar donation to the American Civil Liberties Union and the Immigrant Legal Resource Center. Apple’s CEO Tom Cook reminded staff that Steve Jobs was the son of a Syrian immigrant.

Some traditional firms such as Coca-Cola and Ford have added their protesting voices. Even Budweiser, that iconic brand of the American working class, has had a go at Trump.

Obviously these announcements are in line with good public relations, but they are also a reminder that successful capitalism thrives on diversity, and that firms’ high-value operations aren’t rooted in the USA or in any other location.

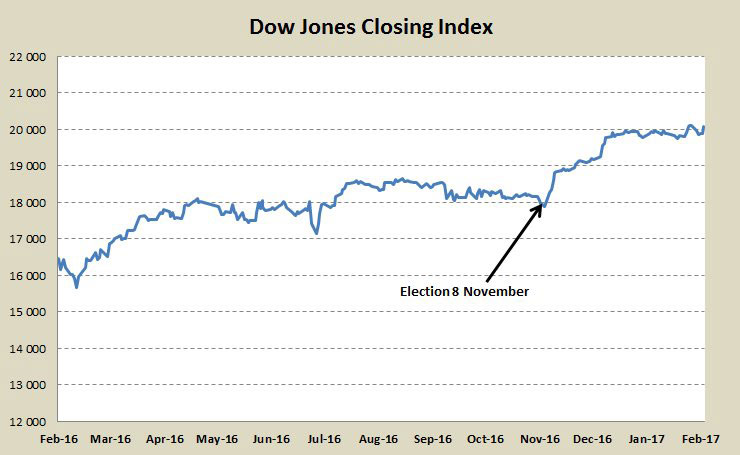

Yet one may respond to this analysis by pointing out that it’s at variance with the view taken by investors, who have shown confidence in the Trump presidency by lifting the Dow Jones index a full 20 per cent since his election, and it has shown no sign of falling.

If the stock market is an efficient mechanism of capital allocation, where well-informed investors with a view to long-term business conditions make cautious and rational decisions, then perhaps I’m just an old left-wing grump, seeking a way to discredit a successful and clear-headed businessman who is going to lead America out of its malaise.

But in reality the stock market is only loosely connected to the real economy. Financial markets have their own dynamics, including positive feedback loops that drive booms and busts.

Undoubtedly there is a group of unthinking partisan investors who would put their faith behind any Republican president. We have the same people in Australia, who on the basis of gut feeling or a sense of class identification, assume that a Liberal Party government is “good for business”, regardless of evidence.

These unthinking partisans can be counted on to give financial markets a boost whenever the political climate shifts to their side. These investors can see a market boom.

There is also a group of non-partisan speculators who believe they can make money out of partisan investors, or of any group gripped by irrational exuberance. They buy into a rising stock market, with the intention of selling before the market peaks.

They have a strong incentive to inflate the bubble, and, gripped by overconfidence, they are sure they can make an exit just before the bubble bursts – getting their money out just before the casino goes bankrupt (the phenomenon is formally known as the greater fool theory).

A few get their timing right, but most go down with the inevitable crash (and if their egos are still intact their next ploy is to short the falling market: it’s a mirror image of the bubble process).

According to the well-respected Shiller Cyclically Adjusted Price Earnings Ratio (CAPE), American stocks, following the Trump bounce, are significantly overvalued – just below where they were in 1929 (Shiller was one of the few to predict the 2008 financial crisis – he’s a more credible source than partisan Republicans).

There could well be a Trump-induced short-term fiscal boost to the US economy, to show up as positive growth in GDP – essentially an artefact of financial accounting – and windfall gains for a few lucky speculators on Wall Street. But there is no indication that Trump’s economic program, if we can call it a “program”, will address America’s deep-seated structural problems: in fact his economic plans, if implemented, will most likely exacerbate those problems.

And while the rich and canny will prosper, those who bear the most pain will be his most loyal supporters.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.