Last night I was in the Q&A studio audience for the first time since 2012. Surprisingly, Joe Hockey said something I wanted to hear.

He made a tentative commitment to scrap the GST on sanitary products, pending the approval of the states.

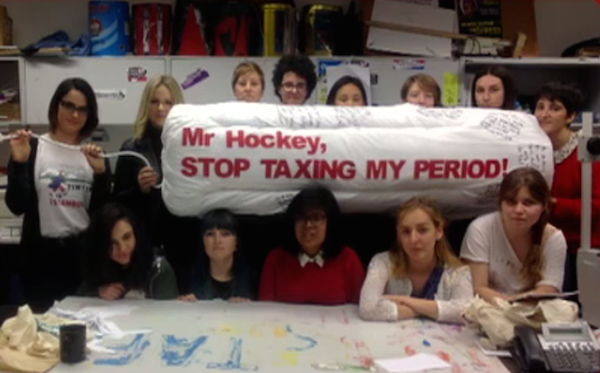

In a video question we submitted to the program the wonderful, passionate members of the Sydney University Wom*n’s Collective held up a giant tampon prop as I asked the Treasurer if he thought sanitary products are essential health items.

.@JoeHockey responds to a question regarding tax reform on tampons & other sanitary products #QandA http://t.co/uAeLFJnNTO

— ABC Q&A (@QandA) May 25, 2015

The GST is a 10 per cent tax on all goods and services. However, there are certain banners under which goods can be exempt.

The banner that sanitary products should be under is that which currently exempts sunscreen, condoms and incontinence pads.

Since John Howard introduced the GST in 2000 the decision not to exempt sanitary products has been persistently challenged. A petition I launched calling for such an exemption now has 92,000 signatures.

It’s hardly a novel issue in Australia either – similar campaigns have been running in Canada and the United Kingdom.

Sanitary products were not simply forgotten, they are specifically and explicitly excluded from exemption under the GST Act.

In the section where “incontinence” medical aids and accessories are deemed GST free, there is a specific note that nappies for babies, sanitary pads, and tampons are excluded. A legislative change is therefore required to remove the tax.

Last night was the closest any politician has come to committing to do that. I certainly did not expect Joe Hockey would be the one to make the move, but I’m glad that something is finally being done.

Sanitary products cost money. It’s unnerving enough that corporations profit from menstruation without the government doing so as well.

Figures from 2013 show the government makes $25 million a year from the GST on sanitary products. It may not seem like a lot per capita, but periods are not uniform for all who experience them.

One of the campaign’s supporters sent me an email about her struggles with endometriosis. She noted that along with hefty medical appointments, the cost of sanitary items is significant for her family as she and some of the other women in her family menstruate for up to three weeks of every month.

A friend’s mother sent me a Facebook message this morning about growing up in a household of five girls and how significant the cost of sanitary products was for their family of eight children.

These are the kinds of people whose stories are erased when we are told to calm down about what is supposedly a few extra dollars a year.

Moreover, given that the GST is a regressive tax, it will always disproportionately affect those who are already financially disadvantaged. Homeless people get periods, single mothers get periods, the unemployed still get periods and they especially shouldn’t have to pay the government extra because of it.

On a principled level, it reflects a broader system of fearing periods, shaming periods and generally refusing to acknowledge them as a reality for millions of Australians.

Joe Hockey’s blushing, awkward laughter and prolonged silence after the video question yesterday was a perfect example of that.

Hockey, who is surrounded by menstruating family members, Cabinet members (not that many of those, I concede) and Australians had to blush and laugh before he could deal with the issue.

That being said, at least he did eventually deal with it.

By contrast, when Tony Abbott was asked about the tax today he spent a good minute avoiding any language remotely connected to menstruation and then deferred to the states, saying it wasn’t an issue for his government to deal with.

Who will deal with it then Mr. Abbott? This campaign has been running for a decade and we still haven’t had a government willing to take the lead.

One of the main responses to the issue (including that provided by Abbott and Hockey before the Q&A appearance) has been that it is not the role of the Federal Government to propose changes and that all the power rests in the states. That is obviously untrue given that Hockey himself noted on Q&A he could (and would) raise it with the states

Legislative changes are proposed to the GST all the time, seen by the recent decision to make Netflix liable to the tax.

A change to the tax on sanitary products does not happen in a vacuum. It would represent a community that is becoming more critical and more progressive. It has been a day, and already five of eight state/territory treasurers have come out actively in favour of scrapping the tax, with none ruling out the possibility.

A lot of people have congratulated me for the petition and the result (so far) and although I’ve been humbled by their words, I certainly know that I have done a marginal amount of the work. It is the work of everyday activists that changes our social consciousness.

The sudden turnaround from the Treasurer and success of this campaign are a great example of how grassroots movements can change communities and influence policymaking.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.