If you think it’s been a tough run for the financial services industry in the US the last few years, you’d be right. But if you’re banking on some brighter times on the horizon… you’d better sit down. Rita Bodrina explains.

It’s been just over a year since the March banking crisis in America, when we saw three of the four largest bank failures in US history. So it should really come as no surprise that to avoid talks of systemic failure and bank runs, the US Federal Reserve (aka ‘the Fed’) swooped in with an emergency ‘Bank Term Funding Program’ (BTFP), to prop up the banking sector.

The purpose of the BTFP is basically to bolster confidence in the banking system, and help ensure stability. The irony of that being needed after such a massive collapse shouldn’t be lost on anyone. Fundamentally, it’s job is to provide cheap loans to banks, savings associations, credit unions and other ‘eligible institutions’… in other words, ‘free money’ to the banking and finance sector to overcome potential ‘liquidity’ problems.

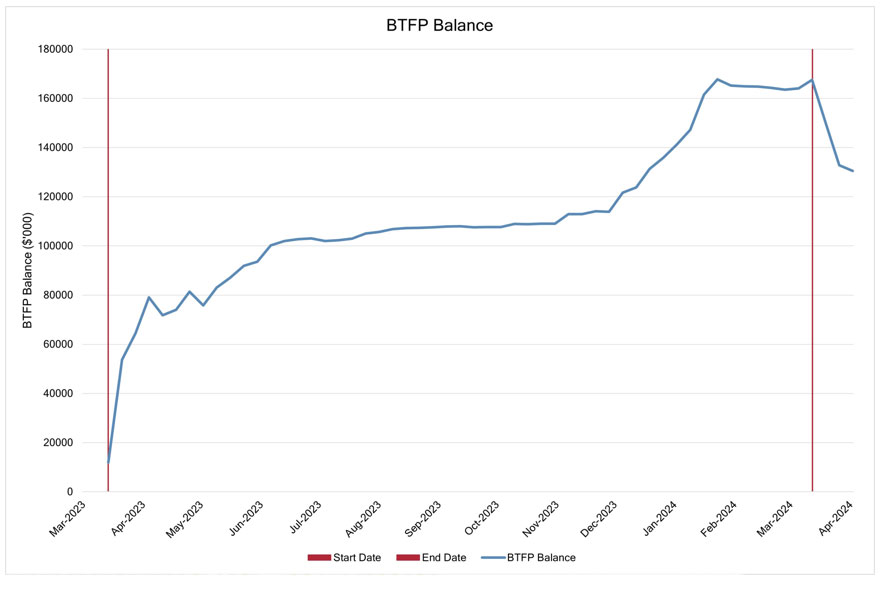

But now, a year later, and having distributed $168 billion, the safety net has expired.

Until the very end, the BTFP has been somewhat of a mixed bag, leaving us with more questions than answers.

What are the likely consequences of ending the BTFP? How could the Fed unabashedly create a Wall Street money-printing arbitrage machine? (Arbitrage is the practice of buying an asset, security, or currency in one market at a lower price and simultaneously selling it in another market at a higher price to take advantage of price differences and generate a risk-free profit. Basically, exploiting temporary price discrepancies between markets for the same asset.)

How much of the borrowing was pure arbitrage versus genuine liquidity concerns? And should we be worried that banks showed more interest in lending to the Fed by borrowing from it, rather than lending to each other and going to the broader economy?

But then again, this ambiguity is typical of the Federal Reserve – buying time rather than providing definitive answers.

Back to the Beginning

Let’s rewind to March 12th, 2023. Silicon Valley Bank had just collapsed. In response, the Fed, in consultation with other banks, devised the BTFP. According to their press release, the original purpose was:

“Additional funding will be made available through the creation of a new bank term funding program offering loans of up to one year in length to banks… pledging …qualifying assets as collateral. These assets will be valued at par.”

At least the Fed learnt a crucial lesson from the 2008 financial crisis – banks need liquidity. The figure circulating was around one third of US banks were at risk of failure without the bailouts. Having probably known this, Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell effectively decided to bail out every bank in America with sweetheart loans written based on fictitious asset values.

One undeniable consequence of having all banks borrow from the Fed is that it has made it impossible for us to see which banks were actually in trouble. When banks turned to the Fed, it was a sign that not all was well, but now everyone is going to the Fed. Meaning we can no longer differentiate between the banks that were going for free money and those that had genuine liquidity troubles.

Sweetheart Loans

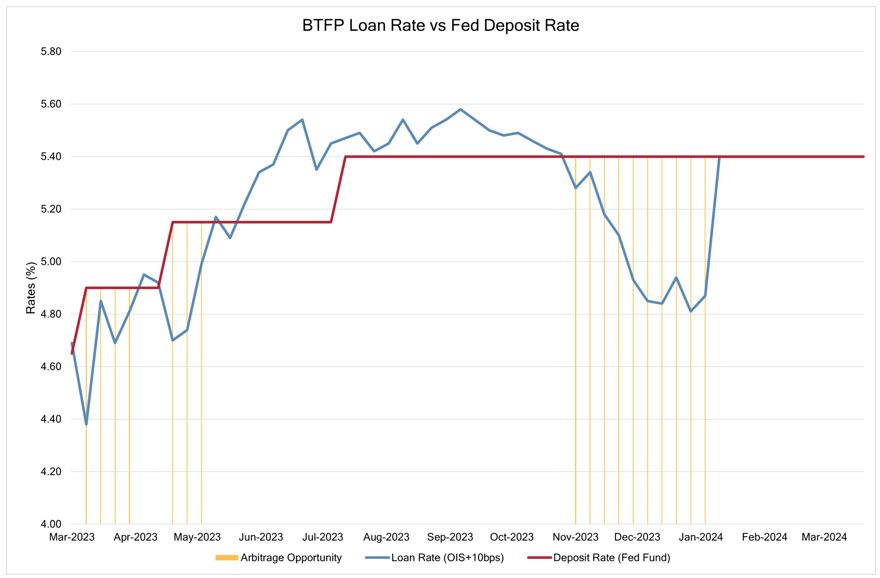

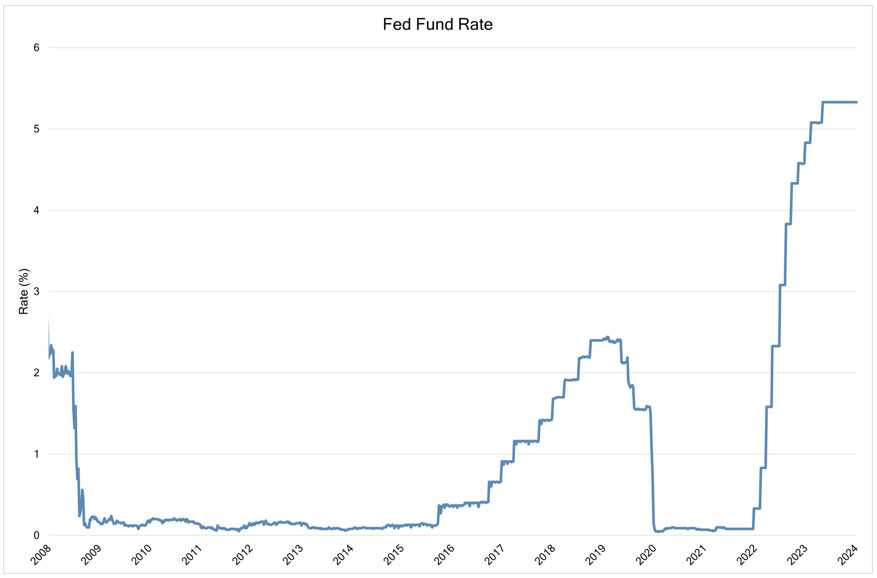

The first thing to remember is that the Fed can both lend out money, and accept deposits. If you wanted to borrow from the Fed using the BTFP you’d be charged the ‘Overnight Index Swap’ rate (OIS), plus 10 basis points, which is a market-based rate.

Alternatively, if you wanted to deposit money with the Fed you could do this at the Fed Fund Rate, which is determined by the Fed itself, not by the market.

This meant that banks could use this setup to borrow from the Fed’s BTFP at the 1-year OIS rate (plus 10 basis points), and then promptly deposit the funds back to the Fed at the Fed Fund rate.

It’s exactly like getting a loan from your local bank at one interest rate and then depositing it straight into the same bank’s savings account at another rate.

In November, the loan rate dropped below the deposit rate. By mid-January the loan rate had decreased to around 4.9%, while the deposit rate remained at 5.4%. This resulted in a half percentage point spread for the banks, with no accompanying risk. A nice little ready-made arbitrage opportunity.

For such an important player in the US economy and with all the ‘smart’ people they have working for them, it’s funny that the Fed wouldn’t anticipate that at some point, this set-up could result in a deep arbitrage opportunity. An alternative perspective is that this scenario was deliberately orchestrated to create just such an opportunity for banks to make, essentially, free money.

“Extra! Extra! Fed printing free money for big bank bailouts! Read all about it!”

Once that was discovered, the Fed obviously couldn’t extend the life of the BTFP, so in January it announced that by March 2024, the free ride would end.

One consequence of the arbitrage opportunity that the banks capitalised on (reflected in a significant increase in the BTFP balance) is the implication that there were no better investment opportunities in the real economy other than parking funds with the Fed.

The Fed’s spread apparently represented ‘peak’ investing for all the ambitious, money-hungry, extreme-capitalist US banks.

Fictitious Assets

The global economic system rests heavily on debt, which banks tend to want to back with some sort of asset. So, it’s completely unsurprising that the issue of collateral keeps coming up again and again.

What should really be jumping out at us from the Fed’s statement is their choice (and it was a conscious choice) to value collateral “at par”. They could have said “at market value”. But they didn’t.

In this context, collateral being valued “at par” essentially means that it’s being valued at what the bank would get if it held everything until maturity, rather than what they would get if they went to market today. Which they obviously would have to do in times of crisis.

If the banks didn’t have access to the BTFP, then they would have had to go to the Fed’s Discount Window, which values collateral based on market value. So, you know, what things are actually worth today.

The question, then, arises: why did the BTFP value collateral “at par”? The answer no-one would want to hear is that the assets the banks are holding are worth jack if they had to be sold today; and to evade this truth, a convenient workaround was devised to value the assets “at par”, back when they had some semblance of value.

So, why has the value of bank collateral gone down the drain? Consider now, that banks are holding bonds issued during a period of very low interest rates… say 2009–2022. When interest rose in 2022, newly issued bonds offer higher yields to investors, making existing bonds with lower interest rates less attractive in comparison, causing their market value to decrease. The par value however remains constant.

If loans were secured by bonds valued at “market value,” these assets may only be a fraction of the collateral needed to secure a loan to cover their liquidity requirements. But “par value” – that’s still nice and high.

This potential shortfall comes off the back of the 2020 decision (in response to Covid) to reduce reserve requirement ratios to zero. (Reserve requirement ratios are the percentage of your deposits that a bank is required to ‘hold in reserve’ – i.e. if you deposited $1,000 with a bank, and the reserve requirement ration was 10 per cent, they would have to keep $100 safe, and could only invest or loan out $900).

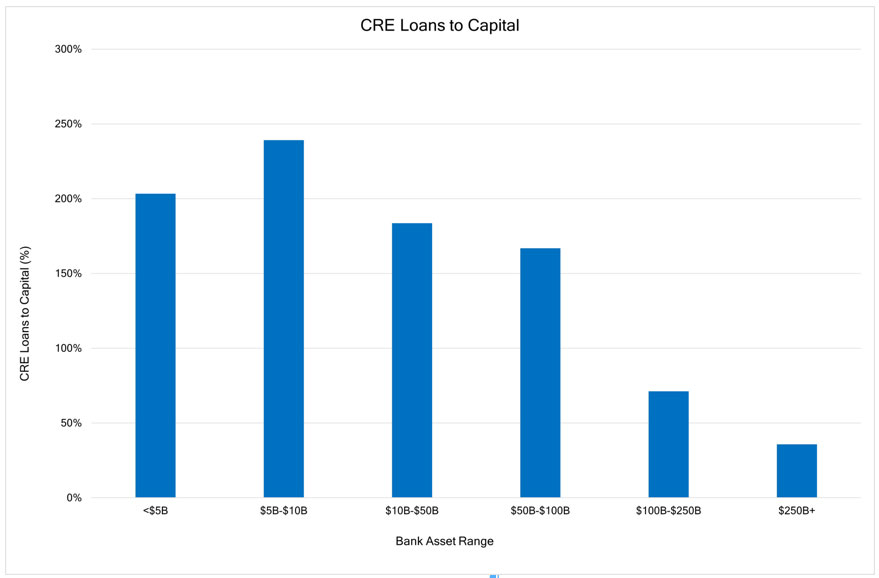

Let’s also try to remember what was the significant shift since the onset of the pandemic: the shift to remote work. Our once bustling offices now sit empty. Consequently, the commercial real estate (CRE) market has been hit hard, facing substantial challenges, with a staggering $929 billion in debt maturing this year, necessitating refinancing or sale. Good luck with that –interest rates are at their highest since 2009, and CRE sales are down 63%! Adding to the complexity, the debt figure represents a 40% increase from the previous year. And couple that with CRE delinquency rates skyrocketing to 6.5%, up from 5.1% the quarter before (a 27% increase).

When the smoke clears, we might witness the fall of dozens, even hundreds, of banks, particularly mid-sized regional ones that tend to have a higher proportion of their assets tied up in CRE. So far, we’ve only witnessed the sickest banks falling out of the pack.

For the last 15 years the Fed policy of flooding easy money to developers has contributed to this mess. So now that interest rates are being pushed up, to quote-unquote “fight inflation”, the value of the debt issued during those years is underwater. But it’s not just CRE; its auto loans, student loans, credit cards, and the myriad derivative bets made against that debt, or its credit quality. CRE is merely scratching the surface of this iceberg – the real danger lurks in the total accumulated debt from the past 15 years that remains hidden from view.

Spending to Save

Central banks are now left trying to balance inflation and a mountain of falling asset prices that are trying to prop up an economy of more debt than ever before. To balance these contradictory requirements, the Fed has set a 2% inflation target to try and gradually erode the real value of debt over time, without triggering major buying-behaviour changes from the public.

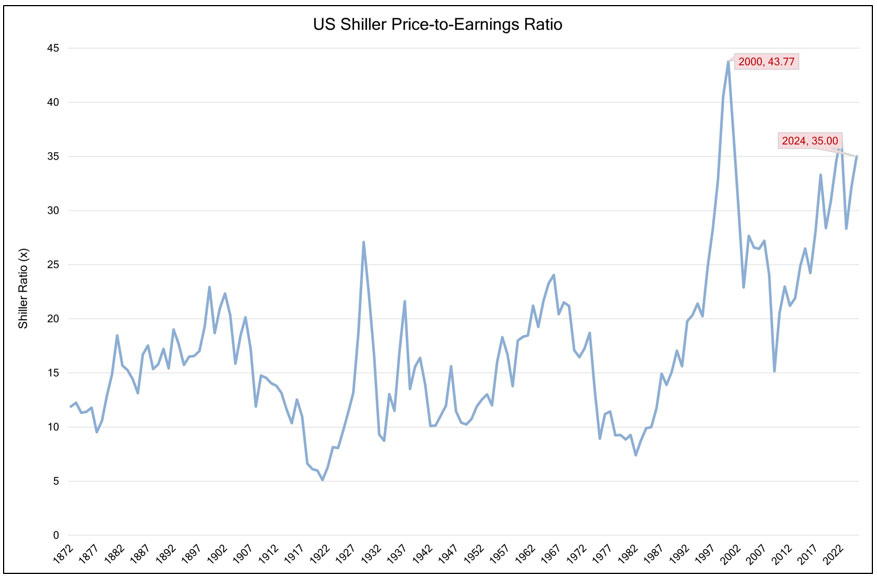

When people lose faith in the currency, they tend to throw their money at anything they think might store value – real estate, gold, cryptocurrencies etc – anything to avoid a loss in value. The equity markets (stock or share markets) hitting record highs despite the disconnect from underlying fundamentals is a symptom of this dynamic. People are wanting to park their money in assets they believe will hold value better than the US dollar. However, this speculative frenzy is not a sustainable solution to the deeper structural issues facing the US economy.

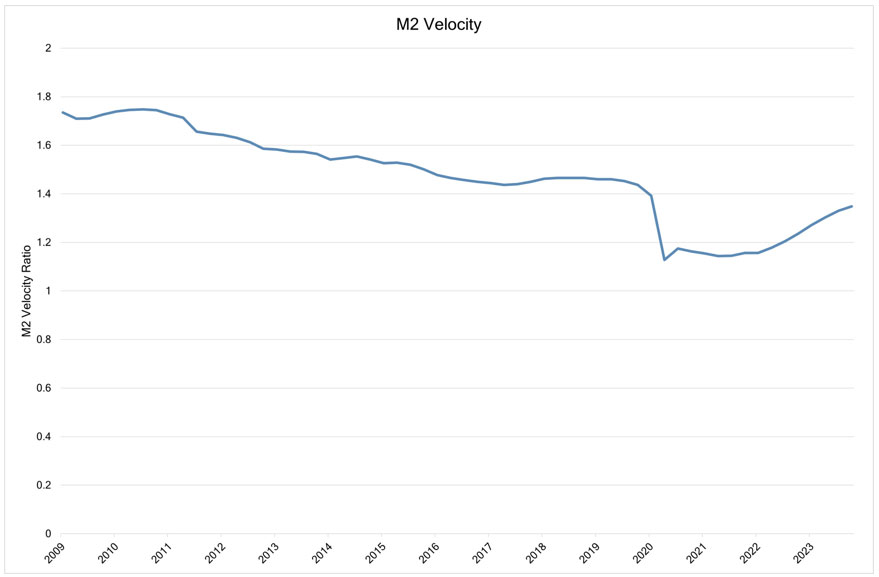

The increasing M2 velocity – the rate at which money changes hands in the economy – serves as a valuable indicator of public confidence in the dollar. There is, however, a fine line between a general uptick in economic activity and public fears about descending into a hyper-inflationary price spiral. So view this metric as a supplement to other analysis.

Repayments Rolling-In

We’ve explored various angles, but let’s circle back to the BTFP. After a year of extending loans, banks now, of course, face the task of repaying them.

During its first week, the BTFP saw an initial lending volume of $12 billion. Subsequently, in response to bank failures, there was a notable surge, with lending skyrocketing up by $42 billion. The following two weeks we saw additional injections of $10 billion and $15 billion, respectively. Culminating in a final loaned volume of $79 billion within the program’s first month.

How banks choose to navigate this repayment process will shed light on their liquidity health.

Banks opting to use the Discount Window, could signal difficulties in accessing private funding sources, all but confirming their collateral inadequacy.

Alternatively, they could choose to draw from their cash reserves or tap into the private marketplace via repo’s (a ‘repo transaction’ is a ‘repurchase agreement’, where one party (in this case a bank) sells securities (such as debt, or assets) to another party with an agreement to repurchase them at a later date, usually the next day or in a few days, at a slightly higher price. Essentially, it’s a short-term collateralized loan).

As the answers to these questions start to come in over the next year, we will start to understand the current state of the US banking system.

Donate To New Matilda

New Matilda is a small, independent media outlet. We survive through reader contributions, and never losing a lawsuit. If you got something from this article, giving something back helps us to continue speaking truth to power. Every little bit counts.